The Chinook Report: 2H 2023

The latest bi-annual report of M&A activity, focusing on global, national, and regional (Pacific Northwest) trends. Includes profiles of transactions generally with an Enterprise Value (EV) between $10 and $100 million.

EXECUTIVE SUMMARY

M&A activity remained muted in 2H 2023, continuing the retreat from historical highs in deal volume and value in 2021. The deal-making landscape faced headwinds which included lingering effects of inflation, rising interest rates, and conservative lending practices from banks, limiting private equity’s access to funding for larger platform investments. Despite these challenging dynamics, middle market M&A volume remained elevated relative to historical activity.

Middle market transactions were fueled by increased interest in smaller add-on deals, representing 76% of private equity transactions in 2023, 10% above the 10-year historical average. Elevated levels of dry powder are expected to support deal activity into 2024, as private equity continues to deploy capital. Pacific Northwest deal volume remained in line with U.S. trends, decreasing slightly but still above the 10-year trend.

As we look to 2024, M&A activity is expected to rebound as credit conditions improve, interest rates soften, dry powder is deployed, and business owners look for exit opportunities. This optimism is offset by rising geopolitical issues in the Middle East, war in Ukraine, a softening Chinese economy, and a current dysfunctional US political system in a presidential election year.

Chinook Capital Advisors has closed a record number of transactions since the COVID period and is on track for its sixth consecutive record year.

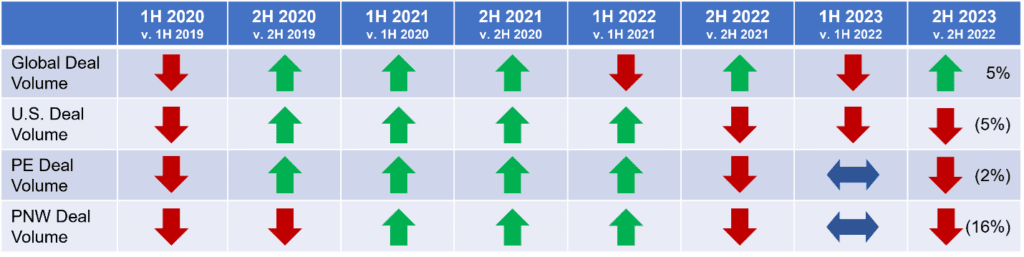

CHINOOK M&A DASHBOARD

CHINOOK M&A DASHBOARD

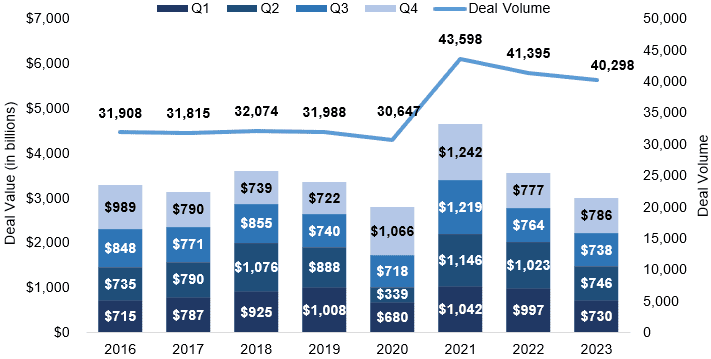

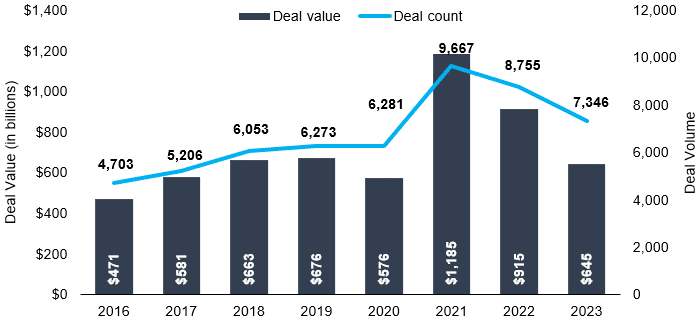

GLOBAL M&A ACTIVITY DELIVERS MIXED MESSAGES

In 2023, global M&A deal volumes were the third highest in the last decade. 2H 2023 deal volume totaled 20,553 transactions, 5% higher than the 19,579 recorded over the same period in 2022, according to the PitchBook’s 2023 Annual Global M&A Report. A total of 40,298 deals were completed in 2023, 28% higher than average pre-COVID levels over 30,000 from 2016-2019.

Global deal values tell a different story. 2H 2023 global deal value decreased 1% to $1.52 trillion, compared to $1.54 trillion in the same period in 2022. Full-year 2023 deal value was $3 trillion, 16% lower than the $3.6 trillion in 2022. Tight credit markets resulted in buyers focusing on smaller deals while fewer “mega” transactions closed (measured as $5B or greater). 2H 2023 deal value was the lowest in 10 years.

Global M&A Activity (2016-2023)

Source: Pitchbook 2023 Global M&A Report

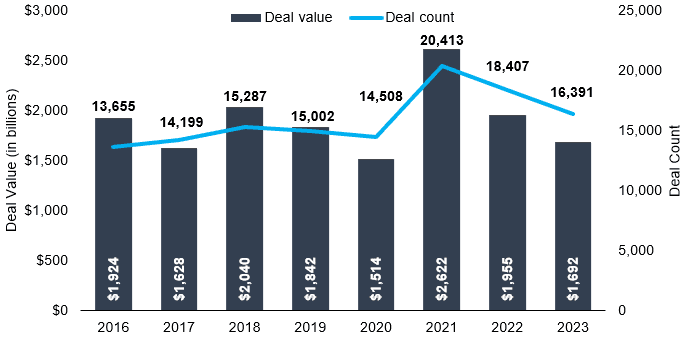

U.S. M&A ACTIVITY FOLLOWS GLOBAL TRENDS

U.S. M&A ACTIVITY FOLLOWS GLOBAL TRENDS

2H 2023 U.S. M&A deal volume decreased 5% to 8,123 transactions compared to 8,655 in the same period last year, according to PitchBook. U.S. M&A deal value was $863 billion in 2H 2023, 7% higher than $806 billion in 2H 2022, but growth was skewed by the acquisitions of Hess and Pioneer Natural Resources, accounting for $125 billion, or 15% of total deal value in the second half of the year. 2023 full-year deal value was 13% lower than the previous year.

In 2023, the U.S. economy maintained strong growth despite uncertainties caused by rising interest rates, geopolitical conflict, and inflationary concerns. GDP grew 3.3% in 2023, outpacing recent years and maintaining the highest growth in the G7. Inflation stabilized with the Consumer Price Index cooling to a 3.4% year-over-year increase at the end of 2023.

U.S. M&A Activity (2016-2023)

Source: PitchBook 2023 Global M&A Report

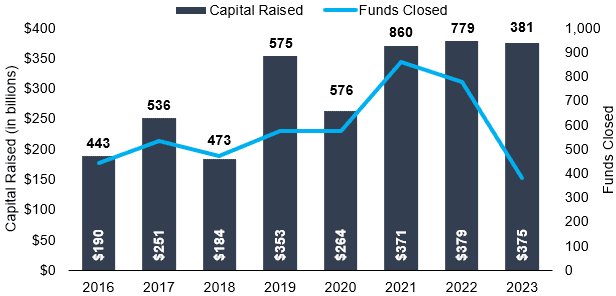

U.S. PRIVATE EQUITY FINISHED WITH NOTABLE DECREASE IN ACTIVITY

U.S. private equity deal volume decreased 2% during 2H 2023 to 4,156 transactions compared to 4,232 in 2H 2022. In addition, deal value fell 13% to $306 billion compared to $366 billion in 2H 2022. The full-year deal value fell 30% to $645 billion compared to $915 billion in 2022, a significant reduction.

Due to its reliance on credit markets, private equity experienced a larger slowdown relative to overall M&A activity in the U.S. On the other hand, deal count stayed strong, with 2023 volumes 32% higher than the pre-COVID average. Deal volumes were supported by more founder-owned businesses selling to private equity (56% of buyouts in Q4 2023) as add-on acquisitions by a platform (76% of buyouts in 2H 2023), which tend to be smaller transactions. The median deal size remains in line with 2022 at $55 million, declining from a record high of $75 million in 2021.

Private equity exits slowed in 2023, with volumes decreasing 39% year-over-year. IPO activity is anticipated to increase in 2024, providing additional liquidity opportunities for private equity firms.

U.S. PE Deal Activity (2016-2023)

Source: PitchBook 2023 US PE Breakdown

![]()

U.S. PRIVATE EQUITY FUNDRAISING REMAINS STRONG

2023 was another near-record year for private equity firms, raising $375 billion, in line with the record $379 billion raised in 2022. Fundraising remained strong despite the median time to close funds extending to over 14 months, the longest since 2011. Middle market funds accounted for almost 50% of fundraising in 2023, raising $180 billion, or 44% higher than the 5-year pre-pandemic average, which can be attributed to the slowdown in Private Equity exits noted above. This marked the fifth consecutive quarter of the middle market outperforming mega funds in fundraising.

U.S. PE Annual Fundraising Activity (2016-2023)

Source: PitchBook 2023 US PE Breakdown

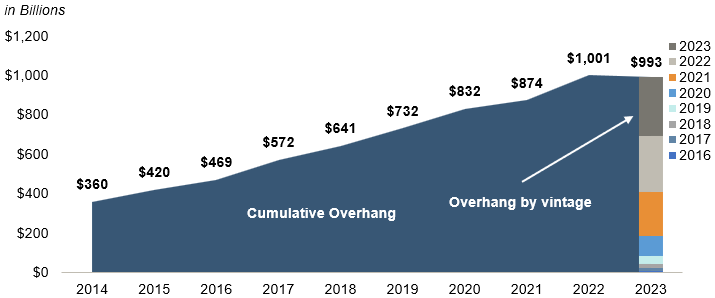

PRIVATE EQUITY DRY POWDER IN ABUNDANCE FOR TRANSACTIONS

In 2023, private equity dry powder hit $990 billion, in line with the record high of over $1 trillion in 2022. This further reinforces investors’ desire for private equity groups to execute acquisition strategies and deliver a return on their capital.

U.S. Cumulative Dry Powder (2014-2022)

Source: PitchBook

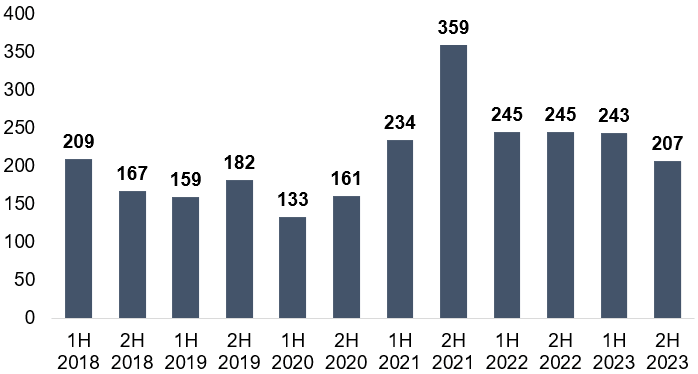

PACIFIC NORTHWEST DEAL VOLUMES DOWN FROM PREVIOUS YEAR

Pacific Northwest deal volume decreased to 207 transactions in 2H 2023 a 16% decrease compared to the 245 in 2H 2022. Full year activity was down 8% to 450 deals compared to 490 in the previous year.

Pacific Northwest Deal Volume (2018-2023)

Source: PitchBook

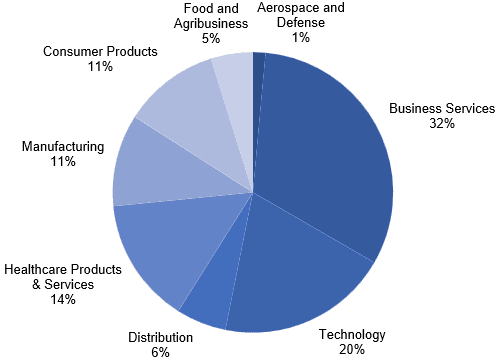

BUSINESS SERVICES AND TECHNOLOGY DEALS CONTINUE TO LEAD PACIFIC NORTHWEST REGION

Business Services and Technology transactions led Pacific Northwest M&A activity during the second half of 2023, consistent with every period since 2019.

2H 2023 Pacific Northwest Deal Activity by Industry

Source: PitchBook

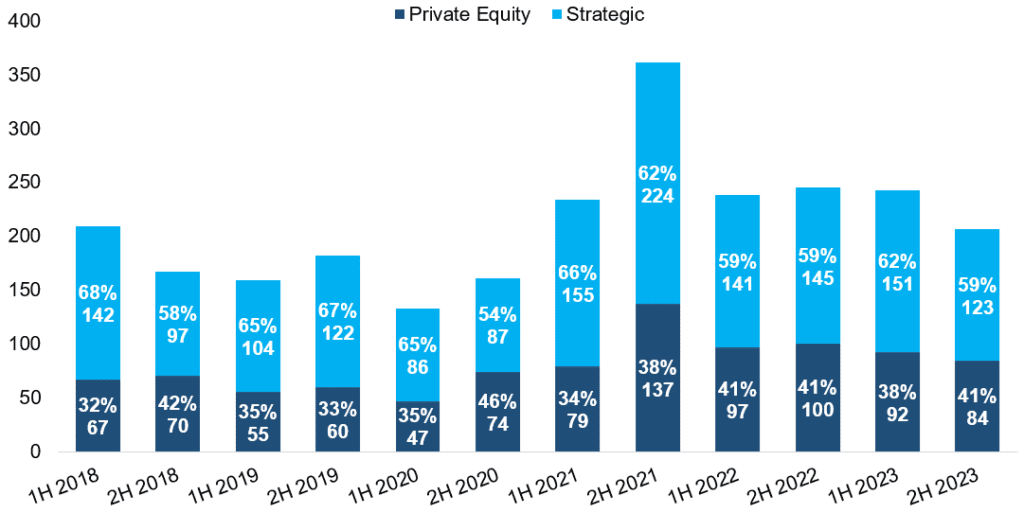

PRIVATE EQUITY INVESTORS REMAIN ACTIVE IN THE PACIFIC NORTHWEST

Private equity represented 41% of transactions in 2H 2023, in line with historical averages, while strategic acquisitions represented 59%.

Pacific Northwest Deal Activity by Investor (2018-2023)

Source: PitchBook

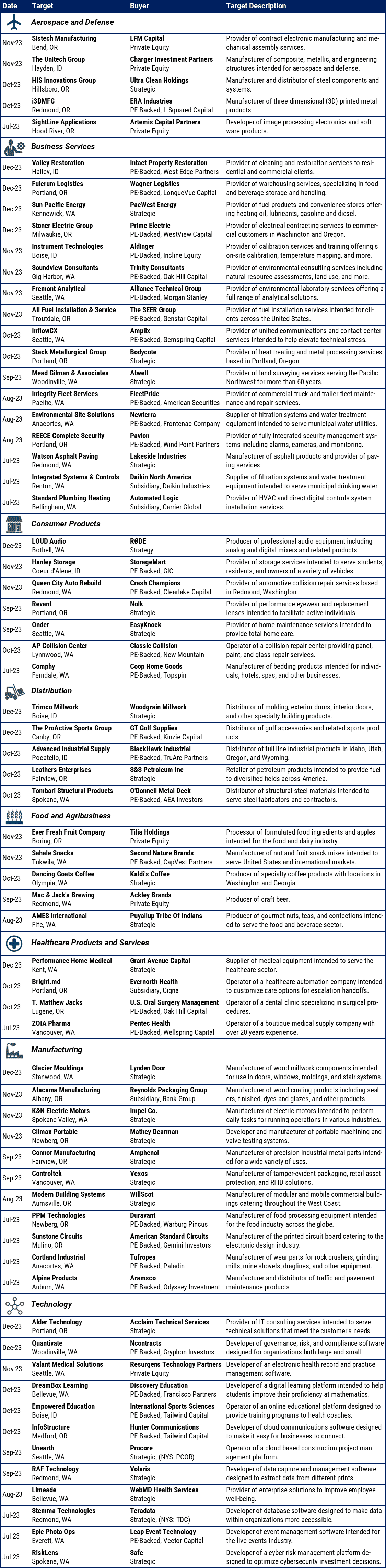

SELECT 2H 2023 PACIFIC NORTHWEST M&A TRANSACTIONS

Sources: PitchBook, Portland Business Journal, Puget Sound Business Journal

![]()