Services

Sell-Side Advisory Service

Seller Representation for Full Sale Transactions

- Analyze business owner goals and transition options

- Create marketing materials to highlight the key value drivers of the business

- Explore the universe of potential buyers to identify and contact top private equity and strategic investors

- Lead negotiations and assist in the preparation of data room, legal documents, financing, and other closing activities

Recapitalizations and Management Buyouts (MBO’s)

Seller Representation for Recapitalization and Management Buyout Transactions

- Access capital for shareholder liquidity, business expansion, or both

- Position key employees to become shareholders through the transaction

- Find experienced investors who can help execute a strategic growth plan

- Position current and/or new shareholders to benefit from future liquidity events

Preparing for a Transaction

Preparing for a Transaction and Advisory Services

- Diagnose and assess current company status with a focus on key performance indicators

- Identify issues requiring attention to maximize value before a transaction

- Educate and update business owners on value drivers and industry-specific M&A issues

- Schedule periodic advisory meetings to track progress on key issues and deliverables

Other Advisory Services

Value-added Service Offerings

- Valuation Advisory Services: Prepare professional valuation of the business to identify value drivers and considerations for a potential transaction

- Debt Advisory Services: Assist companies to access the right bank or other lenders for future growth

- Buy-Side Advisory Services: Execute full process of identifying and approaching target companies to meet long-term strategic objectives

The Chinook Capital Advisors Process

1

Define Shareholder Goals

- Understand who the stakeholders are

- Articulate the ideal outcome, including personal, professional and

financial goals - Identify potential obstacles and issues in advance

- Discuss timing considerations

2

Evaluate Transaction Options

- Analyze valuation and considerations

- Process pros and cons of different transaction options in line with personal, professional and financial goals

- Evaluate timing considerations for each option

3

Determine Value Proposition

- Understand the business strengths and weaknesses

- Understand and evaluate key value drivers

- Position potential investor/buyer considerations in advance

- Focus on growth opportunities

4

Identify Optimal Buyer Profiles

- Deep dive research into entire universe of potential buyers

- Tiered approach with close interaction from client

- High-touch personal outreach to buyers at senior level

- Attention to detail maintains confidentiality

5

Project Manage Sell-side Process

- Project managed to ensure momentum and certainty of close

- Dedicated team approach lead by co-founders

- Beginning to end support from preparation to close

Questions most often asked by business owners and their trusted advisors:

Why Chinook?

Chinook provides a differentiated approach for clients requiring M&A advisory services. Our unique value proposition can be found in the quality of our team, our relentless focus on serving Pacific Northwest business owners, and our proven track record of success.

Team Approach

- Relevant careers in professional M&A roles and business valuation expertise

- Diverse degrees including accounting, finance, engineering, and juris doctor in law allows every client to benefit from the full resources of our entire team

Industry Expertise

- Experience guiding owners from various industries including manufacturing, distribution, business services, technology, healthcare, and consumer products

- Deep investor relationships with industry-specific private equity groups and strategic market players

Local Focus

- We exclusively focus on privately-held businesses based in the Pacific Northwest

- We work as one local team for each client and care about your legacy and our reputation because this is our home

Proven Results

- We act as your trusted advisor and hold your hand through each step – from the beginning to the end of the process

- Over 50 years and 100 completed transactions of experience

How do I determine the value of my business?

We’ve written several articles to help business owners understand the business valuation process:

- What the heck is adjusted EBITDA and why is it so darn important?

- Of Course, Enterprise Value = EBITDA x the Multiple… Uh, So What’s the Multiple?

A business’s value is based on the amount of financial benefits that it’s expected to generate in the future. To predict the future financial benefits of your business, you can either calculate the present value of expected future cash flows, or you can rely on recent past performance. The method of relying on recent past performance to predict future financial benefits is quite common in private company valuations and is calculated by multiplying pre-tax operating income, or EBITDA, by a valuation multiple.

EBITDA X Multiple = Enterprise Value

EBITDA = earnings before interest, taxes, depreciation, and amortization

EV / EBITDA Multiple = commonly used business valuation multiple, determining whether a company is “overvalued” or “undervalued” compared to the market.

Enterprise Value = the sum of the market value of equity and the market value of debt of a company, less any cash.

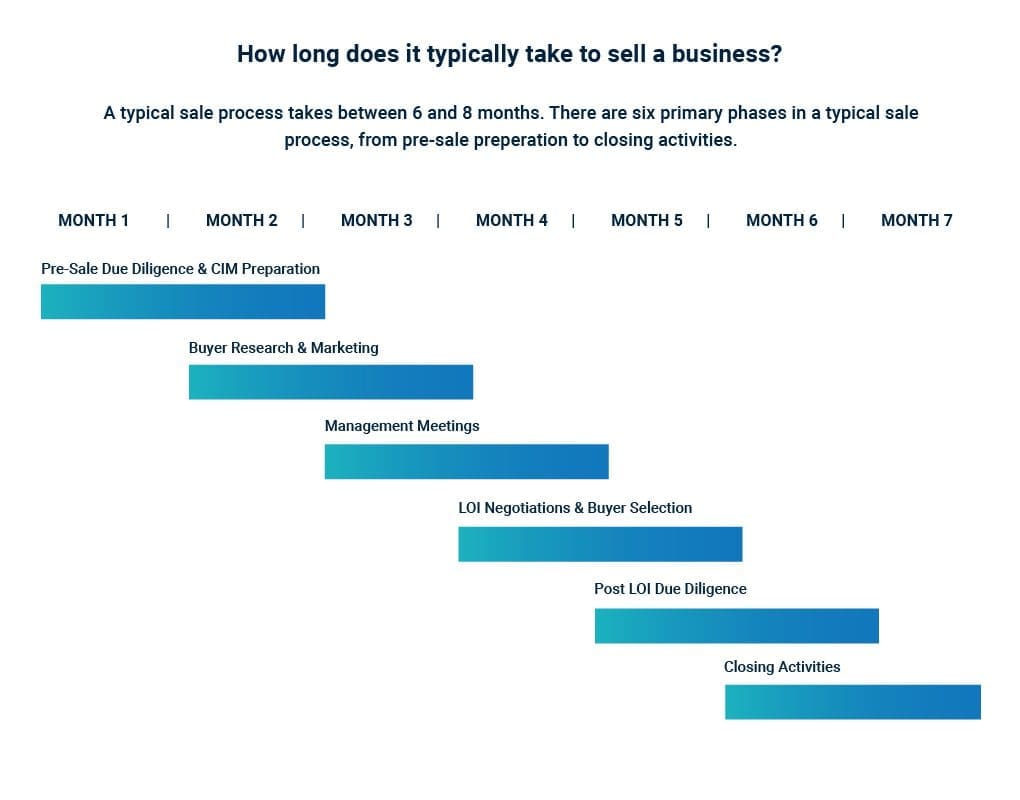

How long does it typically take to sell a business?

A typical sale process takes between six and eight months. There are six primary phases in a typical sale process, from pre-sale preparation to closing activities.

How will I be charged for Chinook's services?

Chinook uses a simple fee structure. There is a monthly retainer spread over 4 months and a success fee calculated as a percentage of the deal value, net of monthly retainers. The Chinook team receives the success fee when you are paid.

Monthly Retainer + Success Fee

How can I avoid risk and build value, while trying to sell my business?

We work with business owners to build value prior to beginning the sale process.

Here are the common steps for building value and avoiding risks in preparing for the sale of your business: