Question #1:

Are you fully prepared for the rigor of third-party financial, operational, and legal due diligence covering at least the last 3 years of business?

Yes or No?

Question #2:

Do you fully understand all of the value drivers in your business from a buyers perspective, and have you proactively taken corrective action to address red and yellow flag issues in advance that would prevent your business from achieving a maximum value?

Yes or No?

Question #3:

Do you fully understand all of the tax implications in the sale of your business, the differences between a stock sale and an asset sale, and have you taken proactive steps to minimize taxes and maximize net proceeds in a sale?

Yes or No?

If you answered yes to all three questions, you are in the minority of business owners we speak with. Most are too busy running their companies to focus on these issues or by nature, tend to procrastinate until something becomes urgent.

What is an Advisory Board?

A select group of professional advisors hand-picked by a business owner to help prepare the company for a transition of ownership. In our experience, the focus should be to:

1) maximize the net proceeds from the sale, and

2) increase the probability that a transaction closes.

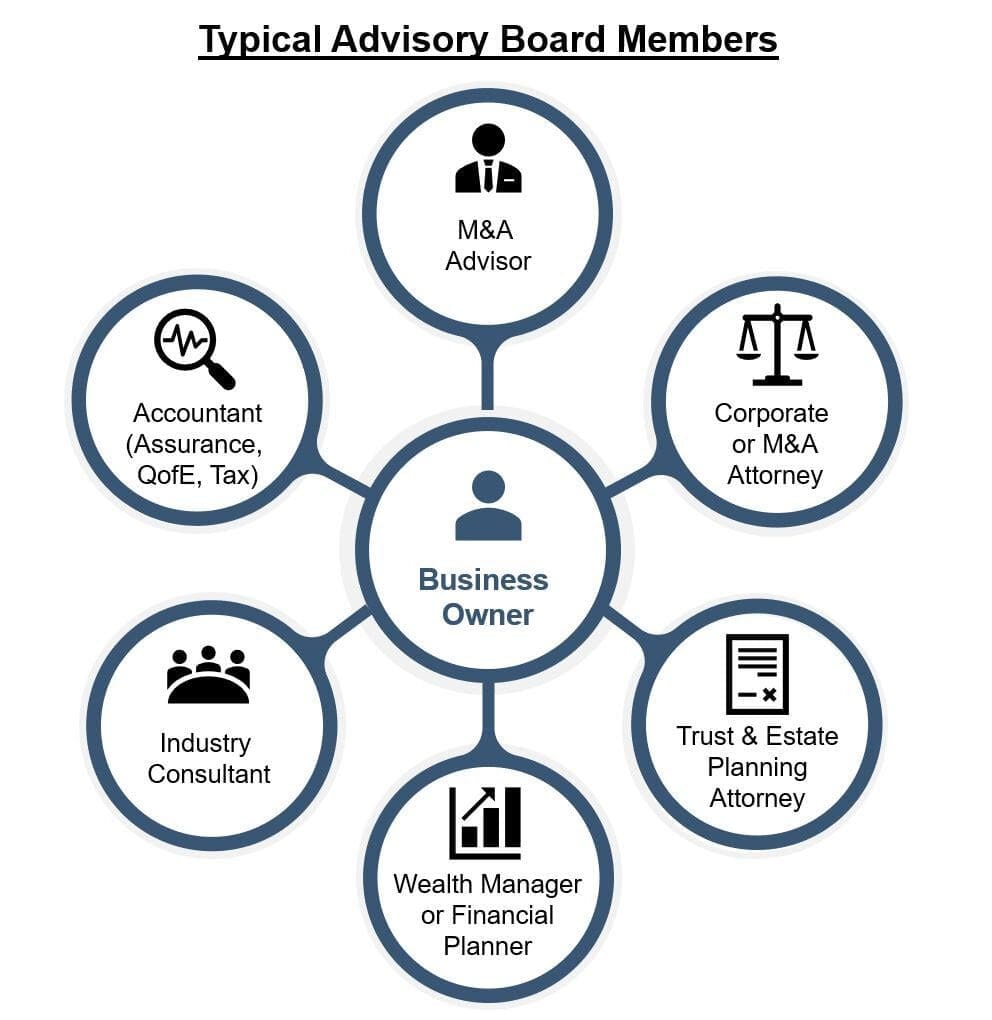

Who typically is on an Advisory Board?

An Advisory Board should generally include an M&A advisor, a corporate attorney with expertise in company sale transactions, and a CPA. Other advisors to include depending on the situation could be a personal financial planner or wealth advisor, trust attorney, or other consultants with expertise in specific areas such as executive compensation or finance. For more details read our previous article on the topic, “It Takes a Team to Sell a Business.”

What does an Advisory Board do?

An Advisory Board helps a business owner identify and resolve specific issues that would reduce the likelihood of their company receiving a premium valuation in a sale. They work as directed by the business owner and do not have any decision-making authority. Advisory Boards can meet monthly, every other month, quarterly, or even semi-annually depending on the situation. Typically, there is an action plan or set of “to do’s” to accomplish before the next meeting. Failing to address these issues with the Advisory Board could potentially reduce a company’s valuation by millions of dollars if they are unresolved prior to a sale transaction.

Case study #1:

Chinook was recently on an Advisory Board for two years prior to a transaction. The Advisory Board met monthly to provide input on key strategic initiatives to ensure that executive level decisions focused on making the business more marketable and likely to receive a higher enterprise value. Chinook recommended hiring an executive compensation consultant to provide retention and other performance-based bonuses for employees as part of the potential sale. The owner could have peace of mind during the transaction that the employees were incentivized to stay in the business during the transaction. In the end, the company was successfully sold with the employees participating in the increased value created. The outcome was a win-win.

Case study #2:

Another company without an Advisory Board was ill prepared for the sale process. Their financials were not ready for the rigors of external financial due diligence and the owner lived in fear of any employee discovering plans for the potential sale. This resulted in valuation adjusting downward from the initial Letter of Intent, and the deal eventually falling apart due to lack of trust. An Advisory Board would have helped prepare the company for a sale while maximizing both the value and probability of close.

Summary:

Selling a business is complex, and since there are no “do-overs”, it is worth the extra effort, time, and money to be properly prepared. The result could be millions of dollars in increased value and peace of mind throughout the process.