The Chinook Report: 1H 2020

This report is published twice a year and provides an update on M&A activity for the first half of 2020 with a focus on global, national, and Pacific Northwest trends. Selected transactions are profiled with an Enterprise Value (EV) generally between $10 million and $50 million. Our data is sourced from GF Data, PitchBook and other publications. GF Data is a member-only subset of information that exclusively focuses on private equity transactions. PitchBook is a leading financial data provider that covers the global venture capital, private equity, and public markets.

CHINOOK M&A DASHBOARD

CHINOOK M&A DASHBOARD

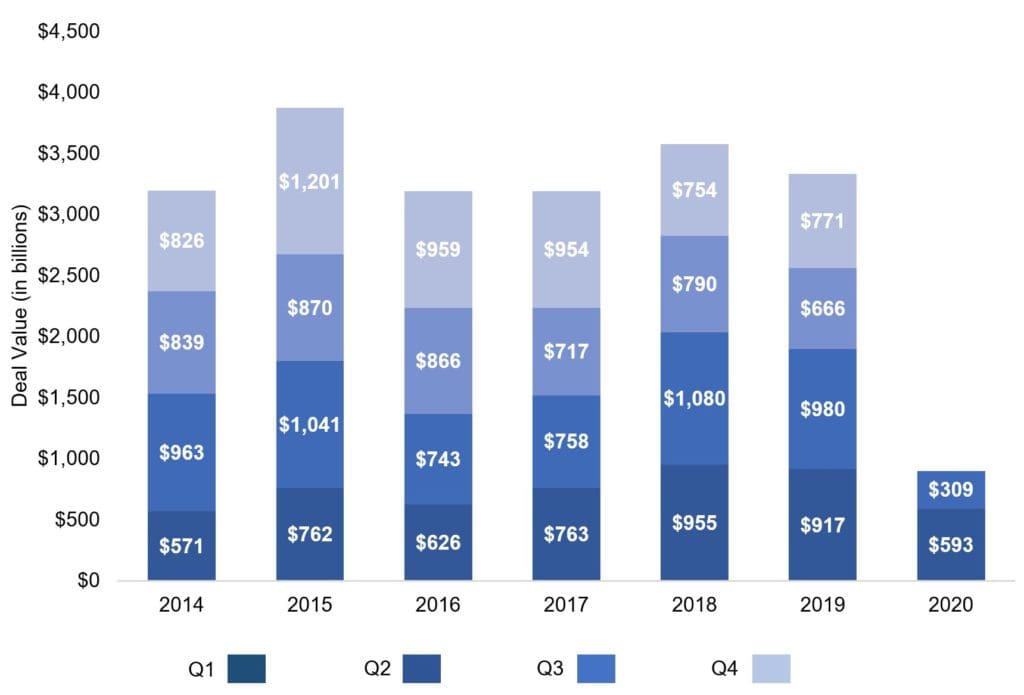

GLOBAL M&A DEAL ACTIVITY AND VALUE DROPPED IN 1H 2020

Global M&A deal volume in 1H 2020 decreased 32% to approximately 6,900 deals, compared to 10,200 in 1H 2019 according to a report by Mergermarket, an M&A research group. Deal value decreased 53% in the first half of 2020 to $900 billion compared to the same period in 2019.

There were six “Mega Deals” valued at $10 billion or more that closed in the first half of 2020 compared to five deals in the same period last year. However, other transactions collapsed during the first half of the year, including Boeing’s multi-billion-dollar deal with Brazilian aircraft manufacturer Embraer and Xerox’s offer for HP.

The COVID impact has been felt globally as all regions have experienced declines in M&A activity, led by the United States. Major economies, like the United States and Canada have announced they are in recession, creating more uncertainties in a world waiting for a COVID vaccine.

Other global uncertainties include whether a meaningful “second wave” of COVID will hit Europe and Asia, the 2020 U.S. presidential elections in November, and the risk of re-escalating trade wars between China and the U.S.

Global M&A Activity (2014-2020)

Source: Mergermarket Global & Regional M&A Report 2020

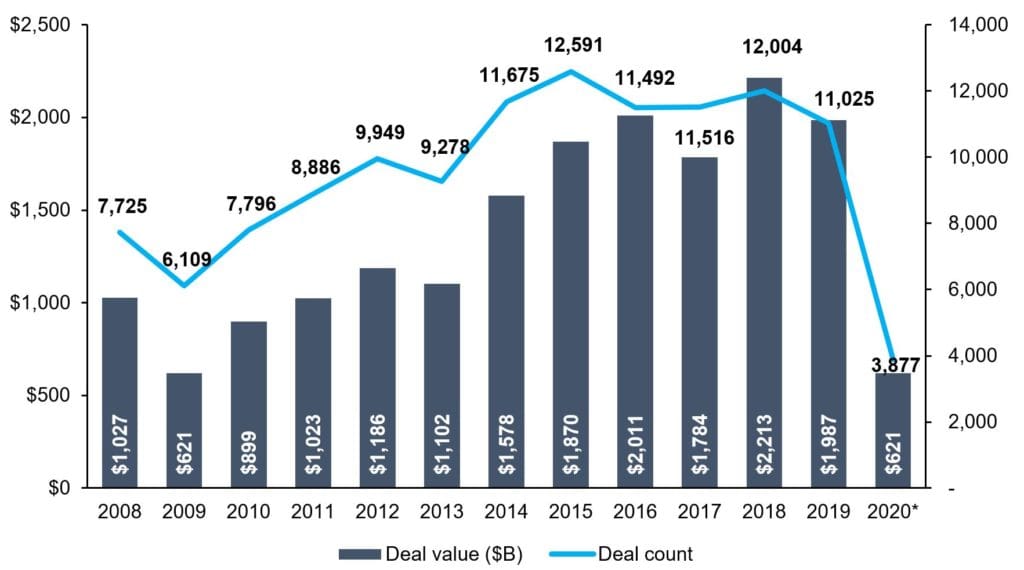

2020 U.S. M&A ACTIVITY REVEALED MIXED PICTURE

2020 U.S. M&A ACTIVITY REVEALED MIXED PICTURE

1H 2020 U.S. M&A deal volume fell 30% to 3,877 from 5,612 in the same period last year. U.S. M&A deal value was $621 billion during the first half of the year, nearly 33.2% lower than $929 billion in 2019.

Despite the current global pandemic, certain sectors like healthcare and technology have seen stable deal activity as they have benefited from COVID. In addition, after declining in the first quarter, the S&P 500 rallied and gained 20% in the second quarter of 2020 following Federal stimulus support.

While the COVID risk in the United States continues to hamper economic growth and provide uncertainty, M&A transactions are still closing.

U.S. M&A Activity (2008-2020)

*Data through June 30. Source: PitchBook 2020 Annual North American M&A Report

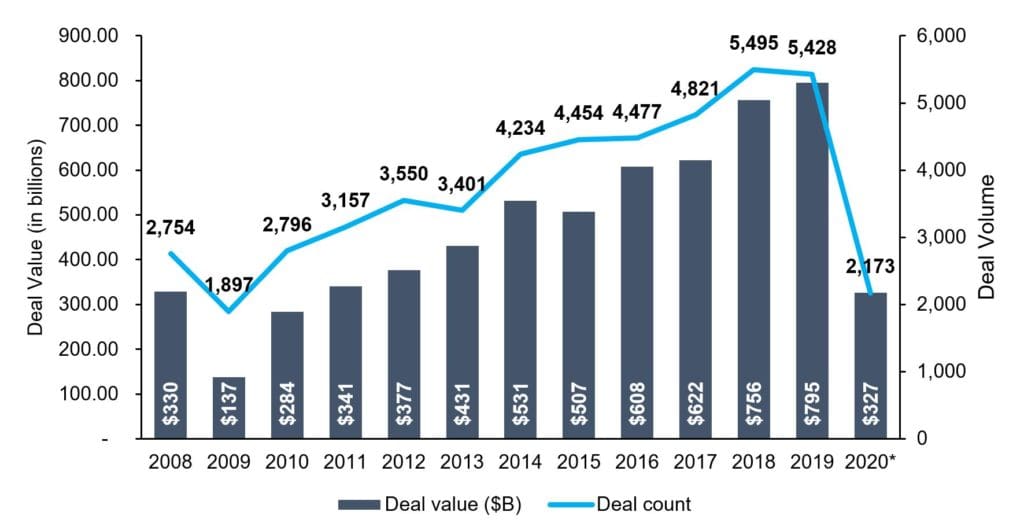

U.S. PRIVATE EQUITY DEAL ACTIVITY DROPPED IN 1H 2020

U.S. PRIVATE EQUITY DEAL ACTIVITY DROPPED IN 1H 2020

U.S. private equity deal volume dropped 19% to 2,173 deals during the first half of 2020, compared to 2,697 in the same period last year, according to PitchBook. Deal value also dropped to $327 billion during the first half of 2020 compared to $405 billion in the same period last year.

The COVID pandemic has caused private equity firms to focus on stabilizing current platform companies. Lenders have been affected by managing current loan portfolios and processing Paycheck Protection Program (PPP) applications from businesses nationwide.

On the other hand, private equity firms continue to look for opportunities, especially in COVID-resistant industries such as e-commerce, technology, and healthcare services. To “normalize” 2020 performance, sellers and their advisors will be focusing on earnings adjustment based on COVID. To learn more, please read our article, “How COVID is Impacting Private Company Valuations.”

U.S. PE Deal Activity Activity (2008-2020)

*Data through June 30. Source: PitchBook Annual 2020 U.S. PE Breakdown

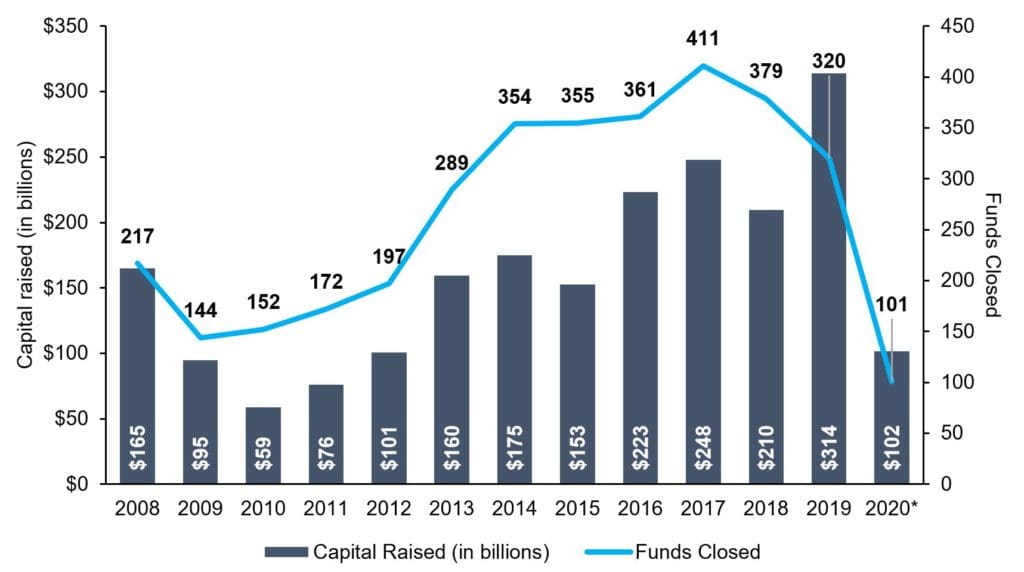

FUNDRAISING STALLS FOR U.S. PRIVATE EQUITY FIRMS

During the first half of 2020, private equity funds raised $102 billion compared to the record $301 billion in 2019 to finance future investment opportunities, despite COVID headwinds.

U.S. PE Annual Fundraising Activity (2008-2020)

*Data through June 30. Source: PitchBook Annual 2020 US PE Breakdown

CUMULATIVE DRY POWDER CONTINUED GROWTH IN 2019

CUMULATIVE DRY POWDER CONTINUED GROWTH IN 2019

Even though private equity buyers are facing internal operational challenges with COVID, there has never been more cash in private markets for transactions. In 2019, cumulative dry powder in the United States reached $740 billion, a 21% increase from the previous year.

U.S. Cumulative Dry Powder (2008-2019)

Source: PitchBook

LOWER-MIDDLE MARKET EBITDA MULTIPLES PAID BY PRIVATE EQUITY DROP SLIGHTLY

LOWER-MIDDLE MARKET EBITDA MULTIPLES PAID BY PRIVATE EQUITY DROP SLIGHTLY

Average EBITDA multiples paid in the first five months of 2020 by private equity groups for companies with an enterprise value between $10-25 million dropped to 5.7x, lower than the full-year 2019 average of 6.1x, although based on a much smaller sample size.

EBITDA Multiples

*Data through June 30th. Source: GF Data

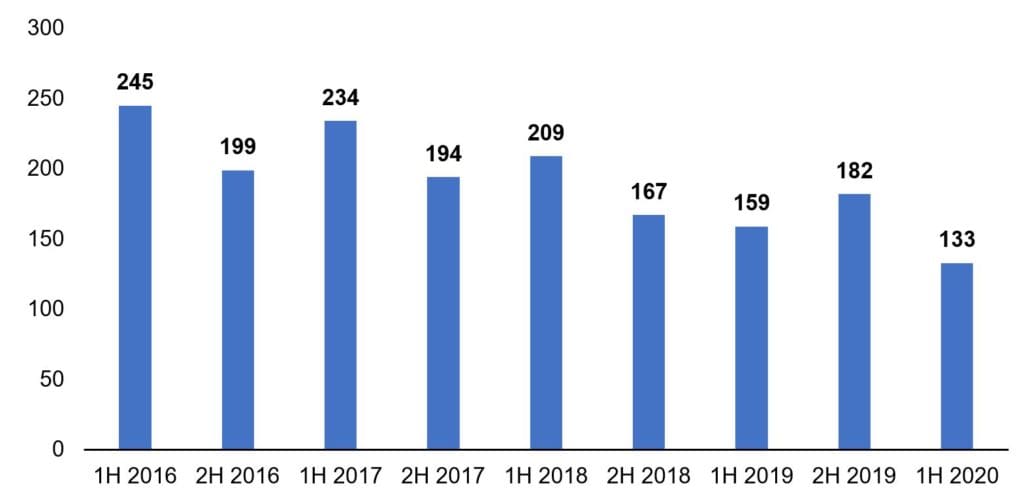

PACIFIC NORTHWEST DEAL VOLUME RECORDS FURTHER DECREASE

PACIFIC NORTHWEST DEAL VOLUME RECORDS FURTHER DECREASE

Total deal volume in the Pacific Northwest decreased to 133 transactions in the first half of 2020 compared to 159 during the same period last year. This represents a significant drop in regional transaction volume compared with previous periods.

Pacific Northwest Deal Volume (2016-2020)

Source: PitchBook

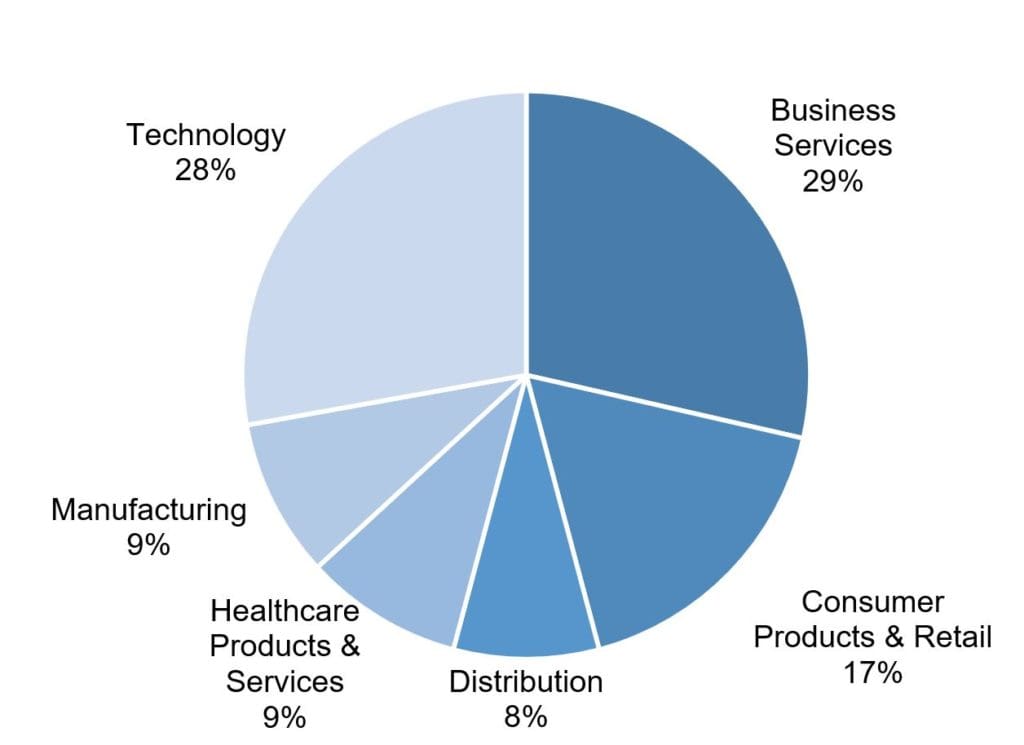

BUSINESS SERVICES AND TECHNOLOGY LEAD PACIFIC NORTHWEST REGION

Business Services and Technology transactions led Pacific Northwest M&A activity during the first half of 2020, similar to previous periods.

1H 2020 Pacific Northwest Deal Activity by Industry

Source: PitchBook

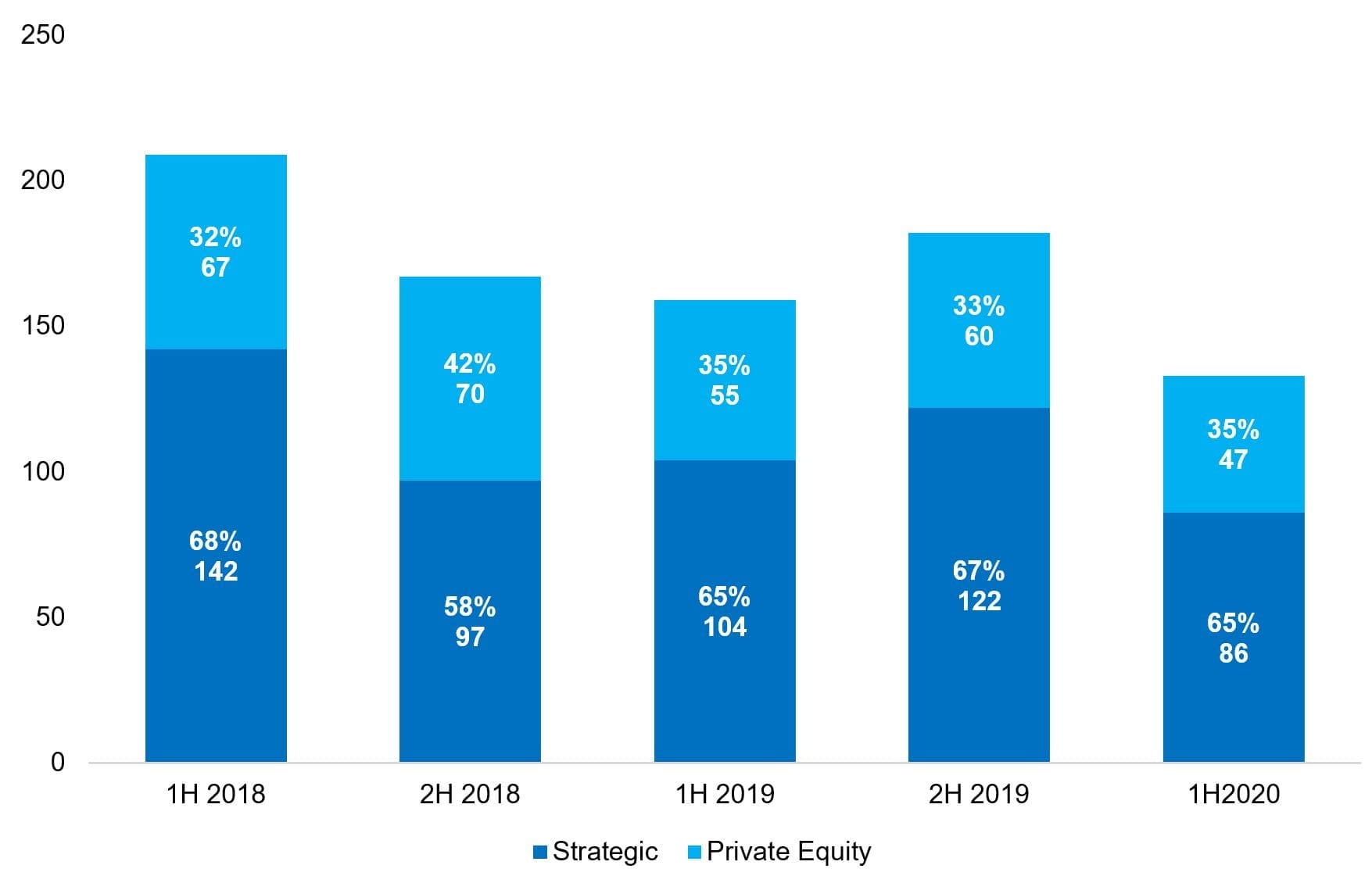

STRATEGIC BUYERS REPRESENT MAJORITY OF PNW DEALS

On average, private equity transactions have represented 35% of deal activity in the Pacific Northwest. This trend continued in the first half of the year.

Pacific Northwest Deal Activity by Investor Type

Source: PitchBook

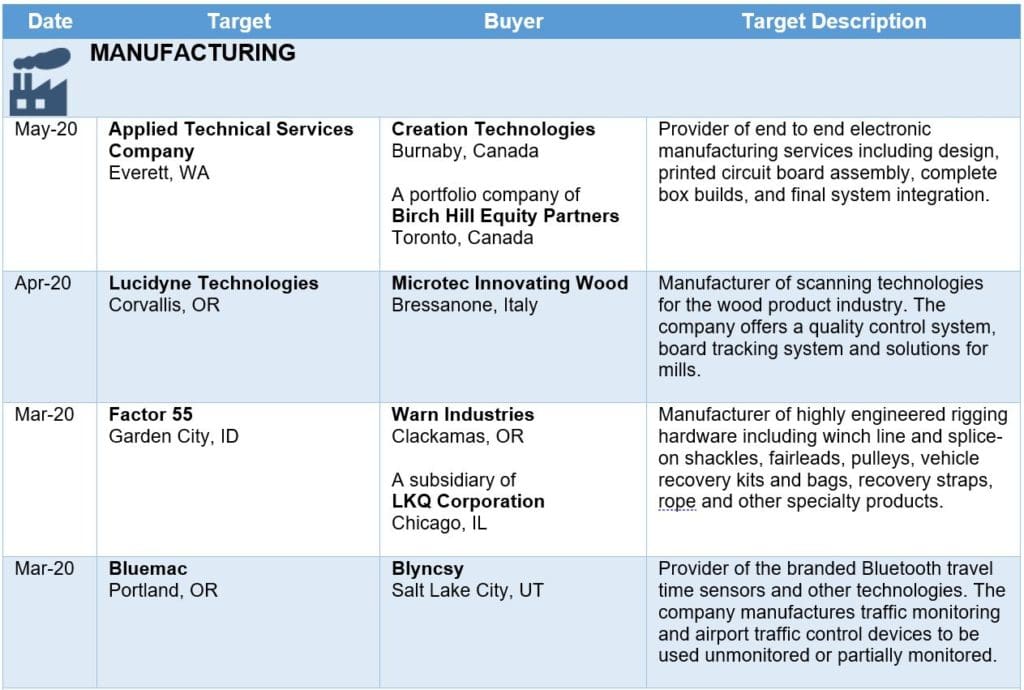

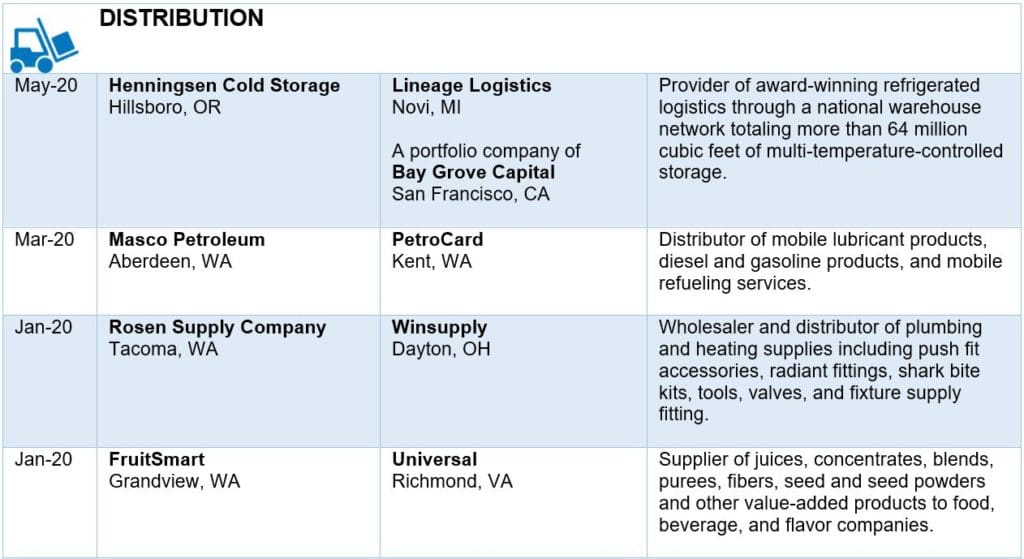

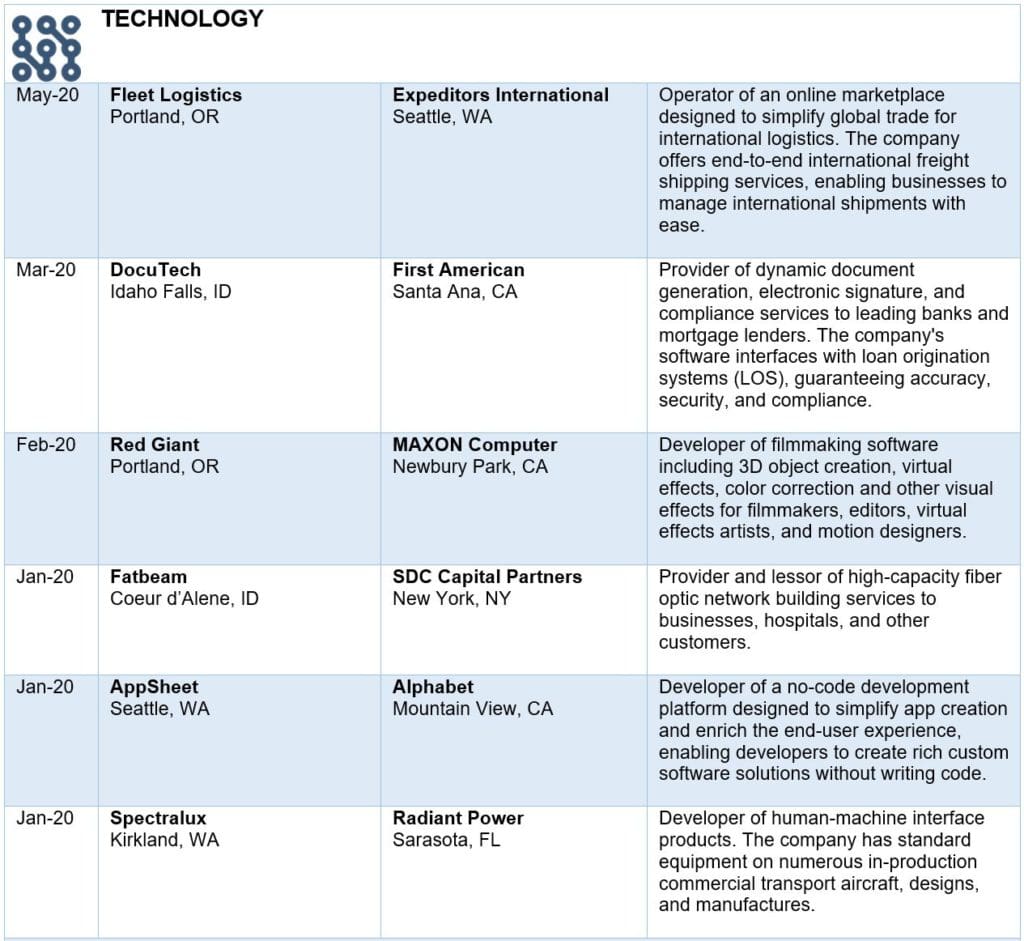

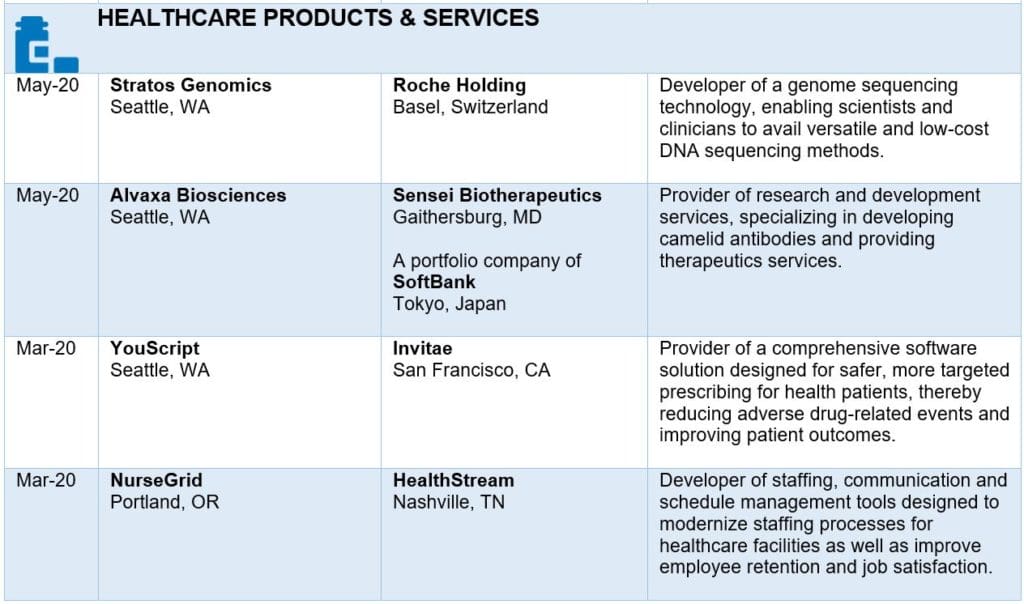

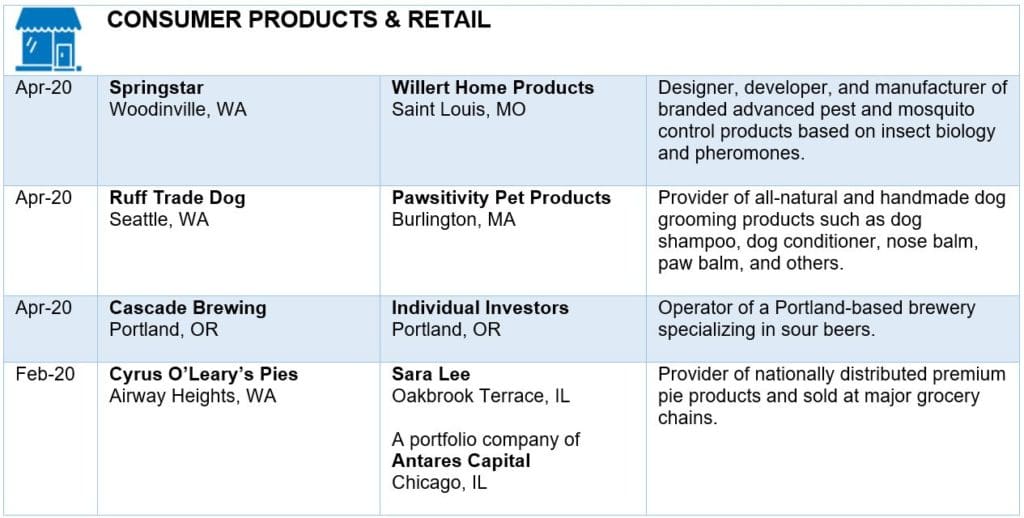

SELECT 1H 2020 PACIFIC NORTHWEST M&A TRANSACTIONS

SELECT 1H 2020 PACIFIC NORTHWEST M&A TRANSACTIONS

Sources: PitchBook, Portland Business Journal, Puget Sound Business Journal