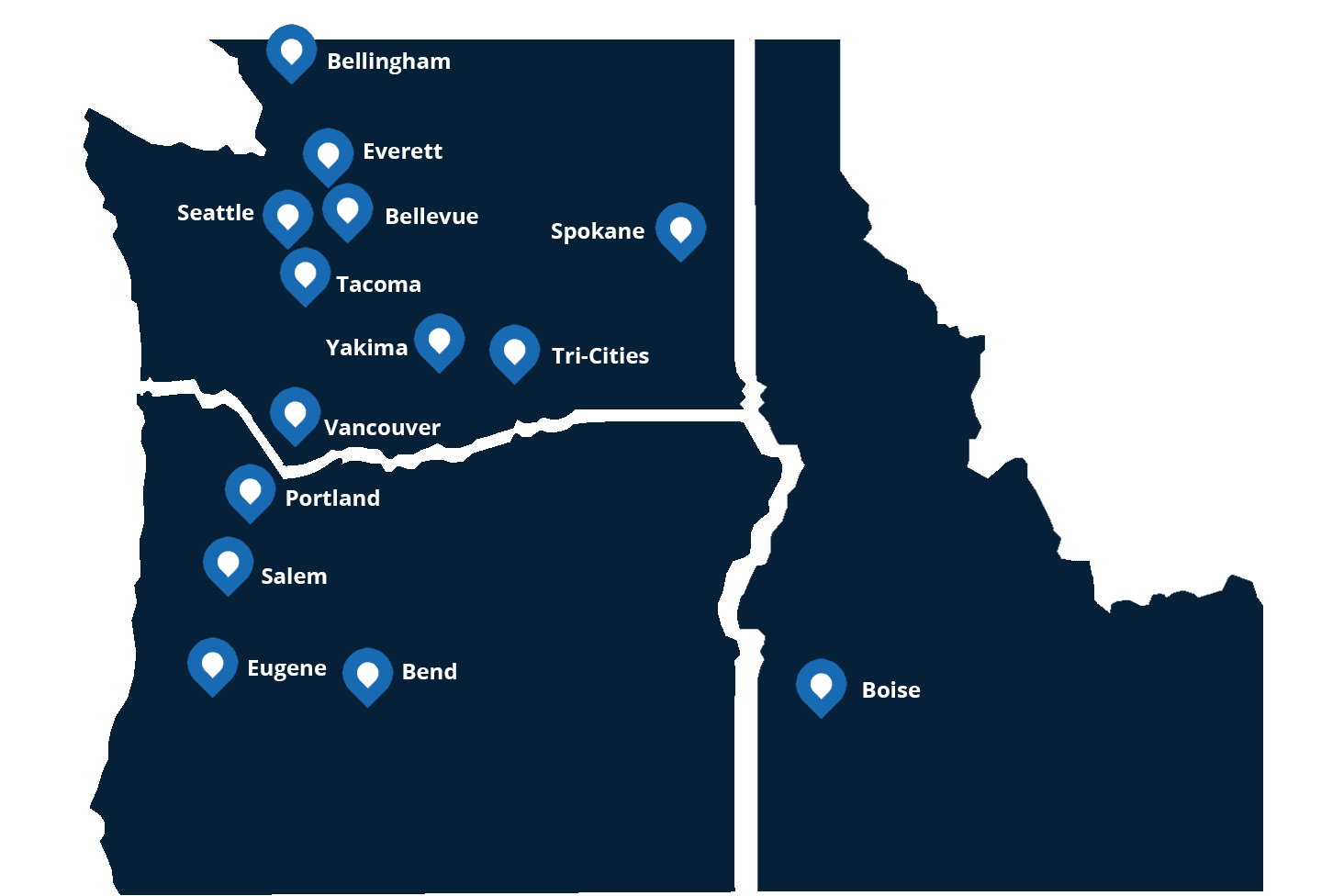

Serving Business Owners in the Pacific Northwest

WHY CHINOOK?

Serving Owners of Privately Held Businesses with Expert M&A Advice

We focus exclusively on privately held and family-owned businesses in the Pacific Northwest. This is our home. We understand the region and offer a deep and well-established network of local investors and professionals to serve our clients. We take a long-term approach to building extensive relationships with our clients.

Our team draws on relevant experience in corporate development, investment banking, tax compliance, and legal planning. We hold several credentials including Business Valuation and Alliance of Merger & Acquisition Advisors (AM&AA) certifications. Each client experiences the full benefits of our entire team, which enables us to meet tight deadlines and maintain momentum through close.

Proven Experience & Results

50

100

80

Our Services

Sell-Side Advisory Service

Representing the owner(s) in a project-managed sell-side process, where the primary goal is a majority or full-sale of the business.

Recapitalizations and Management Buyouts (MBO’s)

Recapitalize the business with new outside capital from private equity, or facilitate a buyout for key employees to gain significant ownership.

Preparing for a Transaction

Assess key value drivers and partner and plan with owners and management on how to maximize value over time ahead of a potential transaction.

Other Advisory Services

Other services, such as business valuation, debt advisory services, and buy-side advisory services.

Serving industries that drive our Pacific Northwest economy

- Manufacturing

- Distribution

- Business Services

- Technology

- Healthcare Products & Services

- Consumer Products & e-Commerce

What Our Clients Have To Say

WE WORK WITH CLIENTS THROUGHOUT THE

PACIFIC NORTHWEST

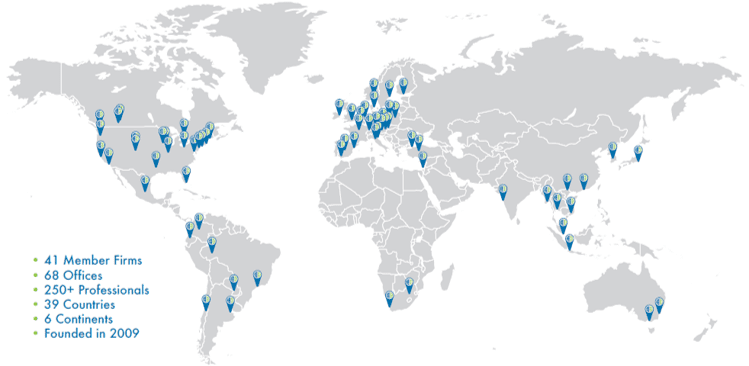

WE PROVIDE ACCESS TO THE MOST QUALIFIED INVESTORS COAST

TO COAST AND GLOBALLY THROUGH OUR MEMBERSHIP IN AICA

Chinook Capital Advisors is a member firm of the Alliance of International Corporate Advisors (AICA), a global network of leading middle-market M&A advisory firms that provides clients with local access to buyers, investors, and acquisition targets around the world. Learn more about AICA, here.

Recent Articles

Let’s Start a Conversation…

ED KIRK

Co-Founder

Chinook Capital Advisors

ed@chinookadvisors.com

mobile: 425.753.0989

Office Location

5145 Carillon Point Bldg 5000, 1st Floor

Kirkland, WA 98033

info@chinookadvisors.com

T: 425.985.7617